fanduel winnings taxed|Frequently Asked Questions : Cebu FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting for any . Tingnan ang higit pa Having a wide variety of games in store, Dafabet Casino offers only the best online slots and live games to our avid bettors. We aim to provide a seamless online gaming experience to our valued players and with that, we continuously maintain a high level data security on top of the assured fair gaming environment.

PH0 · What Taxes Are Due on Gambling Winnings?

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes with FanDuel Sportsbook

PH3 · Taxes

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · Sports Gambling (FanDuel) Income Taxes : r/taxhelp

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · How Much Are FanDuel Winnings Taxed?

PH8 · Frequently Asked Questions

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH12 · Effective Strategies to Handle Tax Withholding on FanDuel

ADAM.CG PRO Font. August 2, 2015. ADAM.CG PRO – previously titled ADAM – is an all caps, sans-serif typeface inspired by Futura. Its sharp, clean appearance makes it a suitable typeface for headlines, posters, titles and captions. It consists of 228 character glyphs and features numerous updates over the previous version, including brand .The Pearce Museum at Navarro College is located on the Corsicana, Texas campus of Navarro College in the Cook Education Center. Three unique and nationally significant collections (Civil War and Texas History, Modern Western Art and Prehistoric Central Texas) are interpreted in interactive, visitor-friendly galleries.

fanduel winnings taxed*******FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting for any . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement. Tingnan ang higit paTax Forms for a particular Tax year will be available for download on or after January 31st of the year after the calendar year in question. For example, 2023 Tax Forms will be . Tingnan ang higit paSome Tax Forms from previous calendar years are available following this link.All you need to do is click the applicable FanDuel products that you play on, select the . Tingnan ang higit paFantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as .Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you . Fanduel winnings can come with tax implications, so it’s always beneficial to plan accordingly. Use the information provided here, along with professional tax advice, to make .

Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to itemize . Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a . If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, and more.I'm looking to confirm my understanding with the taxes that are involved when placing sports bets through a platform like FanDuel. From their website: FanDuel will issue a Form W-2G for each . How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel .Frequently Asked Questions FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off-track betting, .

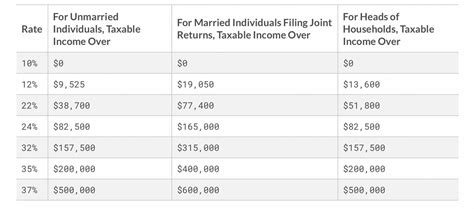

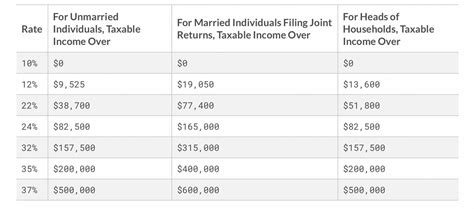

Winnings are taxed at the same rates as regular income. What are the Gambling Tax Rates in Ohio? Ohio gambling taxes are on a graduated scale based on your total ordinary income. Gambling winnings from Ohio sports betting apps will count as “Other Income” but are taxed as part of your total. The parameters change over time, but as of tax .fanduel winnings taxed The following answers general questions on how gambling winnings are taxed in PA. If you’re unsure about a specific tax issue, it’s best to consult a tax professional before filing to avoid any potential mistakes. . Is there a FanDuel Tax Calculator? Gambling taxes in Pennsylvania are not based off of operator but based off of overall .

fanduel winnings taxed Frequently Asked Questions In most states, "Betfair Interactive US LLC dba FanDuel Sportsbook" will issue Form W-2G(s) for online Sportsbook and online Casino winnings. For Sportsbook wagers placed in Indiana that trigger tax reporting or withholding, Blue Chip Casino, LLC will issue your Form W-2G(s). So, here are 8 things to know about how gambling winnings are taxed. . Your reportable winnings will be listed in Box 1 of the W-2G form. If a W-2G is required, the payer (sports betting parlor . Explore the intricacies of reporting FanDuel winnings on your tax return, from understanding tax withholding to tracking losses. Learn how to accurately report winnings under 'Other Income,' document deductions, and use smart strategies to minimize your tax liability. Remember, precision is key to avoiding IRS scrutiny. Calculate tax payments on your gambling winnings free and easily with our gambling winnings tax calculator. Available for use in all 50 states. Hot Offers . FanDuel Named Official Mobile Sportsbook in Washington D.C. by Paul Ricci 03.13.24 10:55 AM . News.

If you win at a sportsbook or casino, they are legally obligated to report your winnings to the IRS and to you if you win up to a certain amount ($600 on sports, $1,200 on slots, and $5,000 on poker). Are gambling winnings taxed on both the federal and state level? The tax rate on gambling winnings will typically vary from state to state.The Player Activity Statement is a larger view of your overall use of FanDuel, with winnings, financial transactions and more. DISCLAIMER - We strongly recommend that you consult with a professional when preparing your taxes. You may need to report your winnings even if you do not receive a W-2G and if nothing is withheld.

New Yorkers with winnings in New Jersey or other states may be required to file a non-resident return if gambling winnings exceeded $5,000. Even if that threshold wasn’t met, include the winnings on your federal and NY income tax returns. Report your total gambling winnings as “Other Income’’ on Form 1040, Schedule 1, Line 8.

The state income tax rate in Arizona ranges from 2.59% to 4.50%, which is the rate your gambling winnings are taxed. Bettors have a responsibility to report their winnings on their income tax return. With new bettors in Arizona, this important to emphasize.The general rule of thumb is to report your winnings once you hit the threshold of $600 or winnings of 300 times the amount you have wagered in a tax year. The sportsbook should send you a Form W-2G. This will make it easy for you to report your winnings on Line 7a of your Form 1040 for the IRS. So if you won $1,000 at DraftKings but lost $1,500 at FanDuel over all of 2021, you can only write off $500 in losses. . Professional bettors report their winnings as self employment income under Schedule C within the 1040. .The amount of your winnings from playing poker (reduced by the wager or buy-in) are at least $5,000; The amount of your winnings from any other type of gambling (except winnings from bingo, slot machines, keno, and poker tournaments), reduced by the wager, are either at least $600 or more or at least 300 times the amount of your wager

Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I don't because I can only send the money on more gambling on the FanDuel site unless I transfer it to my bank account. Key Takeaways. You're required to report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on your tax return.; You can’t subtract the cost of a wager from your winnings.However, you can claim your gambling losses as a tax deduction if you itemize your deductions.; Your deductions for gambling losses can’t .

Share bet slips, FanDuel promos, FanDuel bonuses . I’m pretty sure you just get taxed on your net winnings, and it is a 24-30% federal tax rate. Losses I think cannot be deducted unless you are a business that does fantasy sports for business purposes. So expenses you may have you won’t be able to deduct unless you are a business.FanDuel is a popular daily fantasy sports and sports betting platform that allows users to place bets on various sports and events. One of the most common questions among FanDuel users is whether or not their winnings are taxed. In this article, we’ll explore this question in detail and provide some insights into how FanDuel winnings are taxed.

The winnings from sites including FanDuel are considered income, which means you have to report them to the Internal Revenue Service. . In most cases, winnings greater than $600 will be taxed at .

Free:- Kaspersky, Wisevector Stopx, Comodo(not for rookie users), Bitdefender, Avast. Paid:- Kaspersky, F-Secure, GDATA, Comodo(not for rookie users), ESET Smart Security with Cloud Sandbox. Wisevector Stopx is not as well known, but YT channels like Eclypsee Tech, COMSSTV and J ITech Solutions have reviewed it and you can check them out if .

fanduel winnings taxed|Frequently Asked Questions